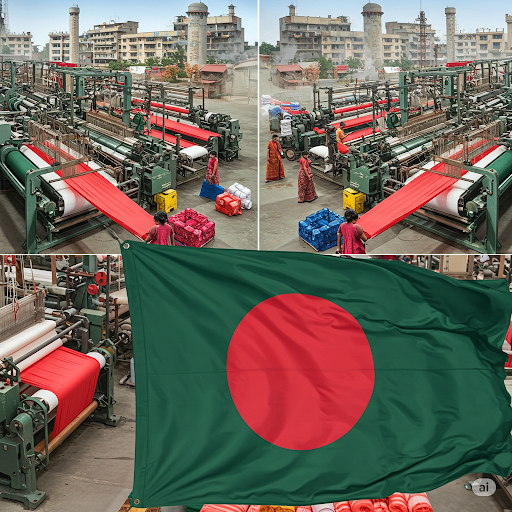

Evolution of the Textile Industry in Bangladesh

The textile industry in Bangladesh boasts a long and rich history, dating back centuries to the famed muslin production during the Mughal era. However, its modern evolution as a global powerhouse began in the late 1970s and early 1980s.

Early Stages (Pre-1980s):

- Traditional Textiles: Bangladesh (formerly East Pakistan) was known for its handloom production of fine cotton fabrics, including the legendary muslin. This sector was largely domestic-oriented.

- Post-Independence (1971): Following the Liberation War, the newly formed Bangladesh faced significant economic challenges. The textile sector was primarily focused on import substitution.

- Emergence of RMG: The late 1970s marked a pivotal point with the establishment of the first export-oriented Ready-Made Garment (RMG) factories. These early ventures, often joint ventures, capitalized on low labor costs and access to international markets.

The Boom Years (1980s – 2000s):

- Export-Oriented Growth: The 1980s witnessed a surge in the RMG sector, driven by factors like:

- Government Support: Policies encouraging private sector investment and export-oriented industries.

- MFA (Multi-Fibre Arrangement): This quota system, while restrictive in some ways, provided guaranteed access to developed country markets.

- Low Labor Costs: A significant competitive advantage.

- Factory Expansion: The number of garment factories grew exponentially, employing millions, predominantly women, and transforming the socio-economic landscape.

- Backward Linkage Industries: Gradually, backward linkage industries like spinning, weaving, and dyeing started to develop to support the growing RMG sector, reducing reliance on imported raw materials.

- Global Recognition: Bangladesh emerged as a major global player in apparel manufacturing, becoming the second-largest RMG exporter worldwide after China.

Recent Developments (2000s – Present):

- Increased Focus on Compliance and Sustainability: Following major industrial accidents like the Rana Plaza collapse, there has been increased international and local pressure for improved worker safety, rights, and environmental sustainability. This has led to significant investments in factory upgrades and compliance measures.

- Diversification and Value Addition: The industry is increasingly focusing on diversifying its product range beyond basic garments and moving towards higher-value items, including knitwear, denim, and technical textiles.

- Technological Upgradation: Efforts are being made to adopt more modern technologies and improve efficiency in production processes.

- Challenges and Opportunities: The industry continues to face challenges such as rising labor costs, infrastructure limitations, energy shortages, and the need for further environmental sustainability. However, it also has opportunities in exploring new markets, developing design capabilities, and strengthening backward linkages.

- Impact of Global Events: Events like the COVID-19 pandemic and geopolitical shifts have presented both challenges (supply chain disruptions, order cancellations) and potential opportunities (shifting sourcing patterns).

- Growth in Technical Textiles: Bangladesh is also showing potential in the Medical and Personal Protective Equipment (MPPE) sector, leveraging its existing textile infrastructure.

Major Players in the Bangladesh Textile Industry

The Bangladesh textile industry is characterized by a mix of large conglomerates and numerous small and medium-sized enterprises (SMEs). Here are some of the major players (this list is not exhaustive and the landscape can change):

Large Conglomerates with Significant Textile and RMG Operations:

- Ha-Meem Group: One of the largest and most diversified groups, with extensive manufacturing facilities across various garment categories.

- BEXIMCO (Bangladesh Export Import Company Limited): A prominent conglomerate with a significant presence in textiles, including spinning, weaving, knitting, and garment manufacturing, including denim.

- Noman Group: A leading manufacturer and exporter of a wide range of textile and apparel products.

- Square Group: A diversified group with a strong foothold in textiles, pharmaceuticals, and other sectors. Square Textiles PLC is a major entity within this group.

- DBL Group: A large conglomerate with significant investments in textiles, garments, and other industries.

- Mohammadi Group: Involved in garments, real estate, power generation, IT, and media, with a strong presence in the apparel sector.

- Epyllion Group: A well-known manufacturer and exporter of knitwear and woven garments.

- Fakir Group: A major garment manufacturer and exporter.

- Standard Group: A leading manufacturing industry in Bangladesh with a significant focus on textiles and apparel.

- Ananta Group: A global leader in garment manufacturing with a substantial workforce and production capacity.

Other Key Players:

- Envoy Textiles Ltd: Notably the world’s first LEED-certified green denim manufacturing facility.

- Akij Textile Mills Ltd: A significant supplier of apparel from Bangladesh.

- Posh Garments Ltd: A well-regarded apparel manufacturer.

Industry Associations:

- Bangladesh Garment Manufacturers and Exporters Association (BGMEA): The apex trade body representing RMG manufacturers and exporters.

- Bangladesh Textile Mills Association (BTMA): The national trade organization representing yarn and fabric manufacturers and textile product processors.

These major players, along with a large number of smaller factories, contribute significantly to Bangladesh’s position as a leading global textile and apparel manufacturing hub. They are constantly evolving to meet international demands for quality, compliance, and sustainability, shaping the future trajectory of the industry. Sources